High Income But Unhappy? Here’s How to Make Your Life (and Money) Feel Better

- Vignesh Sivagnanam

- Jun 30, 2025

- 5 min read

Updated: Feb 16

Work. Nursery drop-off. Calls. Groceries. Bath time. Budgeting. Repeat.

From the outside, life looks successful — especially if you're earning a high income. You’ve got the income, the house, the holidays, the pension. The things you were told to aim for.

But lately you’ve been wondering… “Is this really it?” “Why does this still feel so flat?” “Where did I go in all of this?”

You’re not in crisis. But you’re not thriving either. You’ve built a life that works. But it doesn’t quite work for you.

The Silent Burnout No One Talks About

Most of the parents I work with are doing well — on paper. Good jobs. Stable homes. Healthy kids. A life they’ve worked hard for.

But beneath the surface? They’re high income but unhappy — stretched, drained, disconnected. Not broken, just constantly running. And wondering why none of it feels satisfying.

They’ve lost the sense of who they are. What they want. What it’s all for. That’s what I call the mid-life wobble — and no, it’s not fixed by a holiday or a better spreadsheet.

Your Money Isn’t the Problem — But It Might Be the Mirror

Why Do High Earners Feel Unhappy Despite Success?

Most high earners spend on what they feel they should pay for and things that make life run smoothly, but rarely on what brings genuine joy. Meanwhile, the activities that would light them up get postponed "for later." This disconnect between income and fulfilment creates a sense of working hard but still feeling behind.

You’re not bad with money. But your money might be pointing to the real issue.

Because when I ask clients what they spend on, it’s often:

Things they feel they should pay for

Things that make life run more smoothly — but don’t bring joy

Savings for a future that’s always just out of reach

Meanwhile, the stuff that would light them up? Barely gets a look-in. Or gets postponed “for later.”

That’s where the disconnect creeps in. The guilt. The confusion. The feeling of working so hard and still feeling behind.

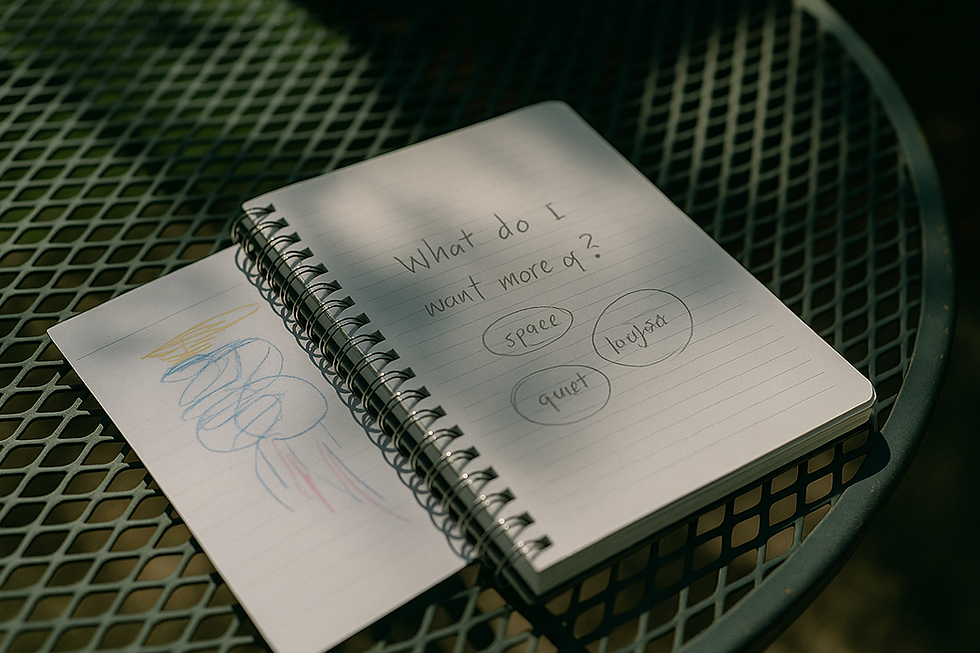

What Do You Actually Want? (And What Would It Look Like to Start Living It?)

Forget financial goals for a second. Let’s talk about values — the stuff that makes you feel alive, grounded, like you.

Values are practical. They help you:

Decide what to stop spending on — without guilt

Know what’s actually worth prioritising right now

Feel good about how your money is showing up in your life

This is the bit most people skip — especially those who are earning well but still feel off-track. They make a budget before they ask: “What do I want my money to do for me — today, not someday?”

If you’re curious how this kind of reflection connects to coaching, you can read more about what money coaching actually is and how it works.

My Wake-Up Moment (Spoiler: It Wasn’t a Spreadsheet)

After I got married and became a parent, I stopped doing the things that made me feel like me. No more road trips. No car shows. No track days. I’d convinced myself those things didn’t matter now.

During lockdown — when everything paused — I realised how far I’d drifted. I wasn’t burned out. But I was numb. And that scared me.

So I made a change. I reshaped our budget. Started spending — intentionally — on the things I’d shelved.Encouraged my wife to do the same. It wasn’t a dramatic life overhaul.

But bit by bit, we felt like ourselves again.

We still get it wrong sometimes. But now we know what to come back to.

Try This: A 30-Minute Reset That Could Change Everything

If you’ve read this far, here’s something small but powerful you can do right now:

Block 30 minutes. No screens. No noise. Just you (and ideally your partner).

Ask these 3 questions:

What parts of life feel genuinely good right now?

What’s draining me more than it should?

If I had £500 to spend guilt-free this month, what would I spend it on — and why?

Spot the themes.

Are you craving peace? Fun? Autonomy? Creativity? Rest? These are clues to what’s missing — and what you need more of.

Test it.

Choose one value you want to lean into. Then make one decision this week that honours it.

Download my free Values Based Budgeting worksheet to help you spot what really matters to you before you try it yourself.

One couple I worked with did this and realised they’d cut out all spontaneity from their lives. They took £150 from their next pay cheque and booked a last-minute babysitter and dinner out — just the two of them. It wasn’t about the money. It was about remembering they’re a team.

What If You and Your Partner Want Different Things?

You probably do. And that’s completely normal. The key is not agreement — it’s awareness.

Try this together:

Do the reset exercise separately

Share your answers — no debate, just listen

Each pick one small thing to protect or prioritise this month

If one of you rolls your eyes at this stuff? Don’t push. Start small. Keep it light. But don’t avoid it altogether. You deserve a life that supports both of you.

What Happens If You Do Nothing?

Staying stuck doesn’t feel like standing still. It slowly takes something from you.

You’ll keep saying no to time with your kids now, assuming there’ll be more later.

You’ll carry a quiet resentment in your relationship — because you’re not speaking up about what you need.

You’ll wake up each Monday already exhausted, with no idea when it’ll feel better.

You’ll build a life that looks like success, but never actually feels like your own.

You’ll keep spending on things that don’t matter. Keep putting off the stuff that does. And live in a loop that feels fine on paper, but hollow in real life.

And then one day you’ll look back — and realise you missed the window to enjoy the life you worked so hard to build.

Or You Could Start Rewriting Things Today

You don’t need a full financial overhaul. You just need space to get clear on what’s working, what’s not, and what’s next.

That’s what the Insight Session is for.

It’s a one-off, 2–3 hour coaching session — a starting point for high-income individuals who feel stuck — where we:

Review your current financial setup

Spot blind spots and inefficiencies

Give yourself space to make better decisions — and actually enjoy the results

We won’t go deep into values right away — but we will give you the clarity to start shifting your money toward the life you want.

If you’re stuck in the fog, this is where things start to feel manageable again.

Read more about the Insight Session or book a free Q&A call if you want to talk it through.

No pressure. No judgement. Just space to stop drifting — and start building something better.

Written by Vignesh Sivagnanam — a UK-based money coach helping high earners who feel stuck use their money to build a life that actually feels good.

Comments